Ratings

Rating agencies

Renault SA is rated by four credit rating agencies (CRAs):

- 2 international CRAs: Moody’s and S&P Global Ratings

- 2 Japanese: R&I and JCR

In August 2023, Moody’s upgraded Renault's rating to Ba1 with stable outlook.

In March 2023, R&I changed outlook to stable from negative, affirmed A- rating.

In February 2023, S&P changed outlook to stable from negative, affirmed BB+ rating.

In November 2022, JCR affirmed Renault's A- rating with a stable outlook.

In November 2022, Moody’s changes outlook to stable from negative, affirms the Ba2 rating.

In June 2022, R&I affirmed Renault’s A- rating with negative outlook.

In April 2022, Moody’s affirmed Renault’s rating to Ba2 with a negative outlook.

In March 2022, S&P affirmed Renault's rating BB+ with a negative outlook.

In October 2021, JCR revised Renault's A- rating outlook from negative to stable.

In September 2021, Moody’s affirmed Renault’s rating to Ba2 with a negative outlook.

In March 2021, R&I affirmed Renault’s rating at A- with a negative outlook.

In March 2021, S&P affirmed Renault's rating BB+ with a negative outlook.

In October 2020, JCR revised Renault's A- rating outlook from stable to negative.

In August 2020, R&I revised Renault’s A- rating outlook from stable to negative.

Ratings

| Agency | Long-term rating | Short-term rating | Outlook | Latest press release / Credit analysis |

|---|---|---|---|---|

| Moody's | Ba1 | NP | stable | |

| S&P Global Ratings | BB+ | B | stable | |

| R&I | A- | - | stable | News Release Mar 2023 |

| JCR | A- | - | stable | Press Release Nov 2022 |

Debt profile

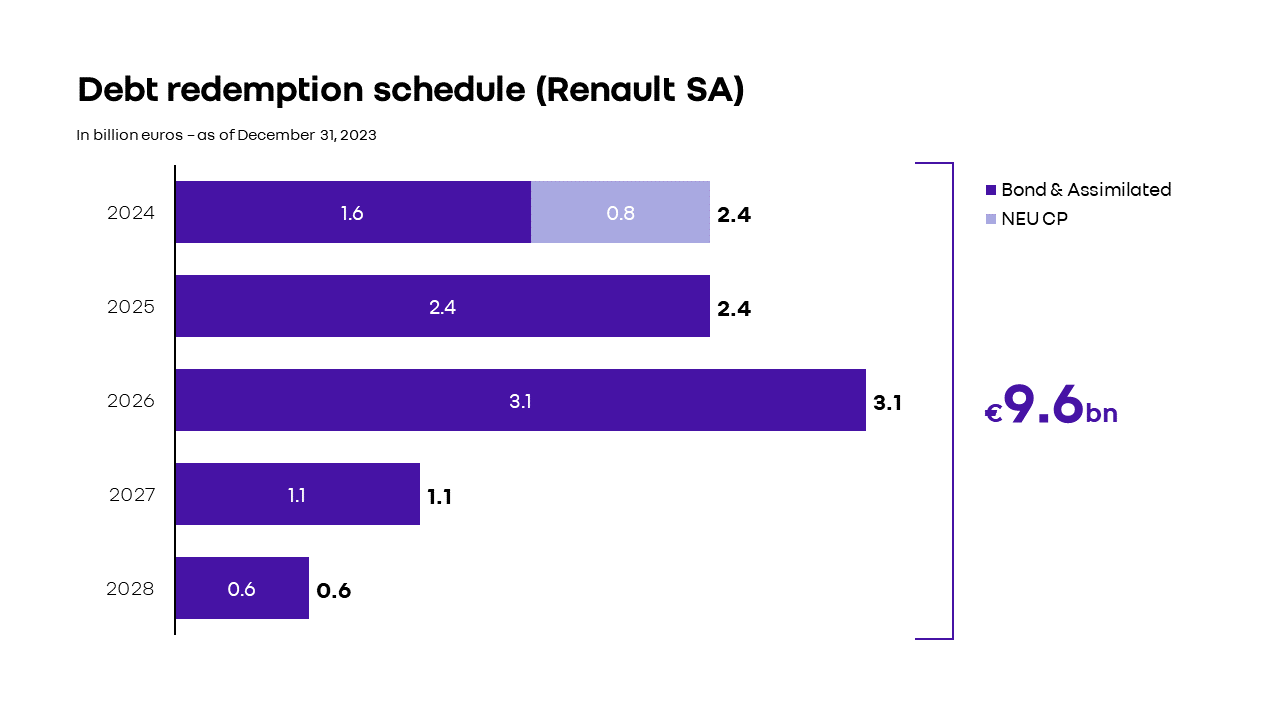

Redemption schedule of bonds, bank and equivalent debt for Renault SA as of June 30, 2023 (including NEU CP, excluding redeemable shares)

Renault SA ensures most of the refinancing for the Automotive business in the capital markets, mainly through long-term funding (bonds and private placements) and short-term financing such as NEU CP.

To this end, Renault has an EMTN bond program with a ceiling amount of €10 billion, a Shelf Registration program of ¥400 billion for the Japanese market and a Neu CP program of €2.5 billion.

Debt issue programme

It is vital for the Group to use different sources of refinancing to fund its automotive business. Accordingly, Renault SA has arranged three insurance programs

- Access documentation on debt issue programs

- Access 2023 Universal Registration Document, 2022 Universal Registration Document, 2021 Universal Registration Document, 2020 Universal Registration Document, 2019 Universal Registration Document, the Amendment - 2019 Universel Registration Document and 2018 Universal Registration Document

Debt issues

Details on public and private bond issues.